| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

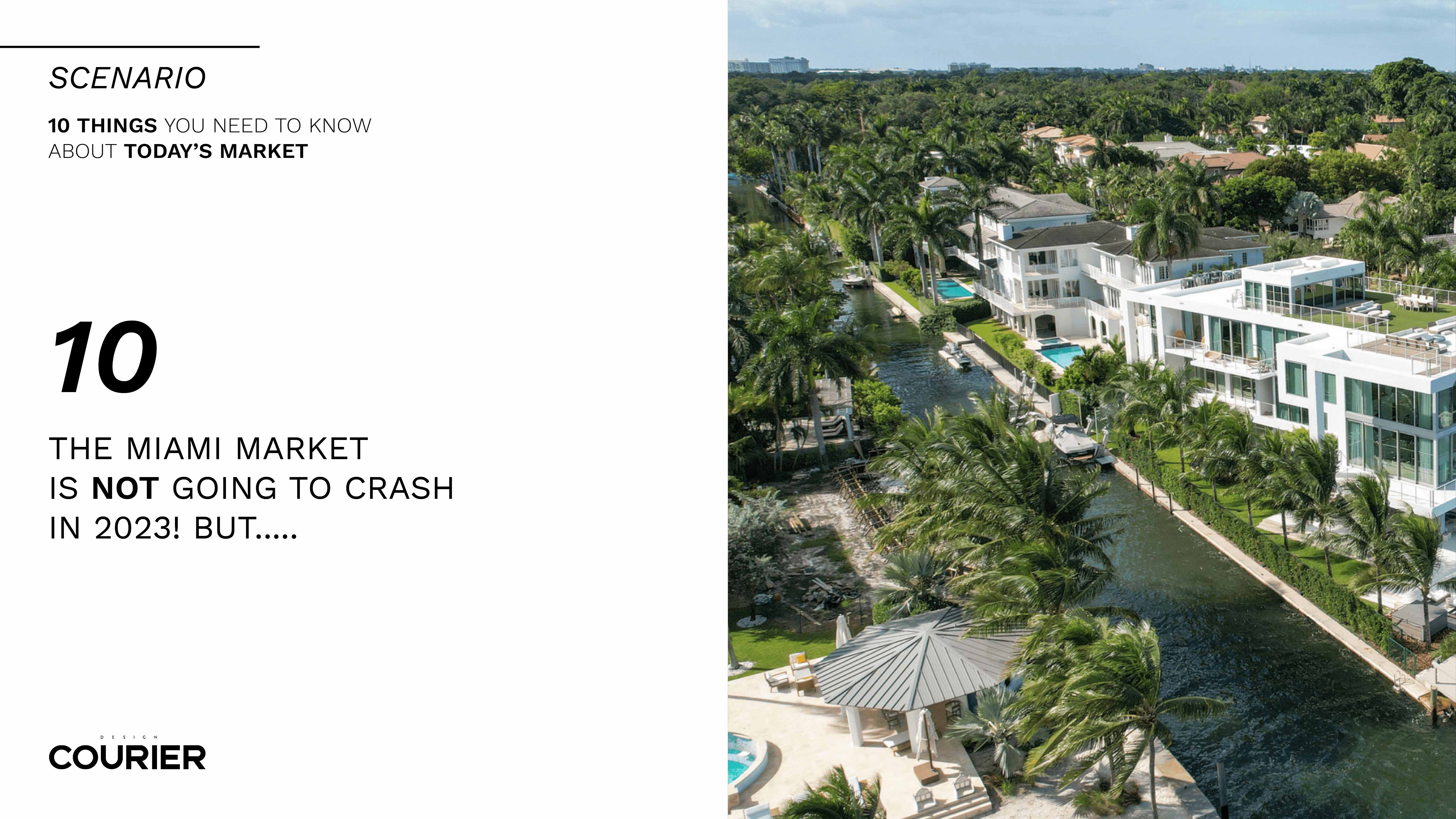

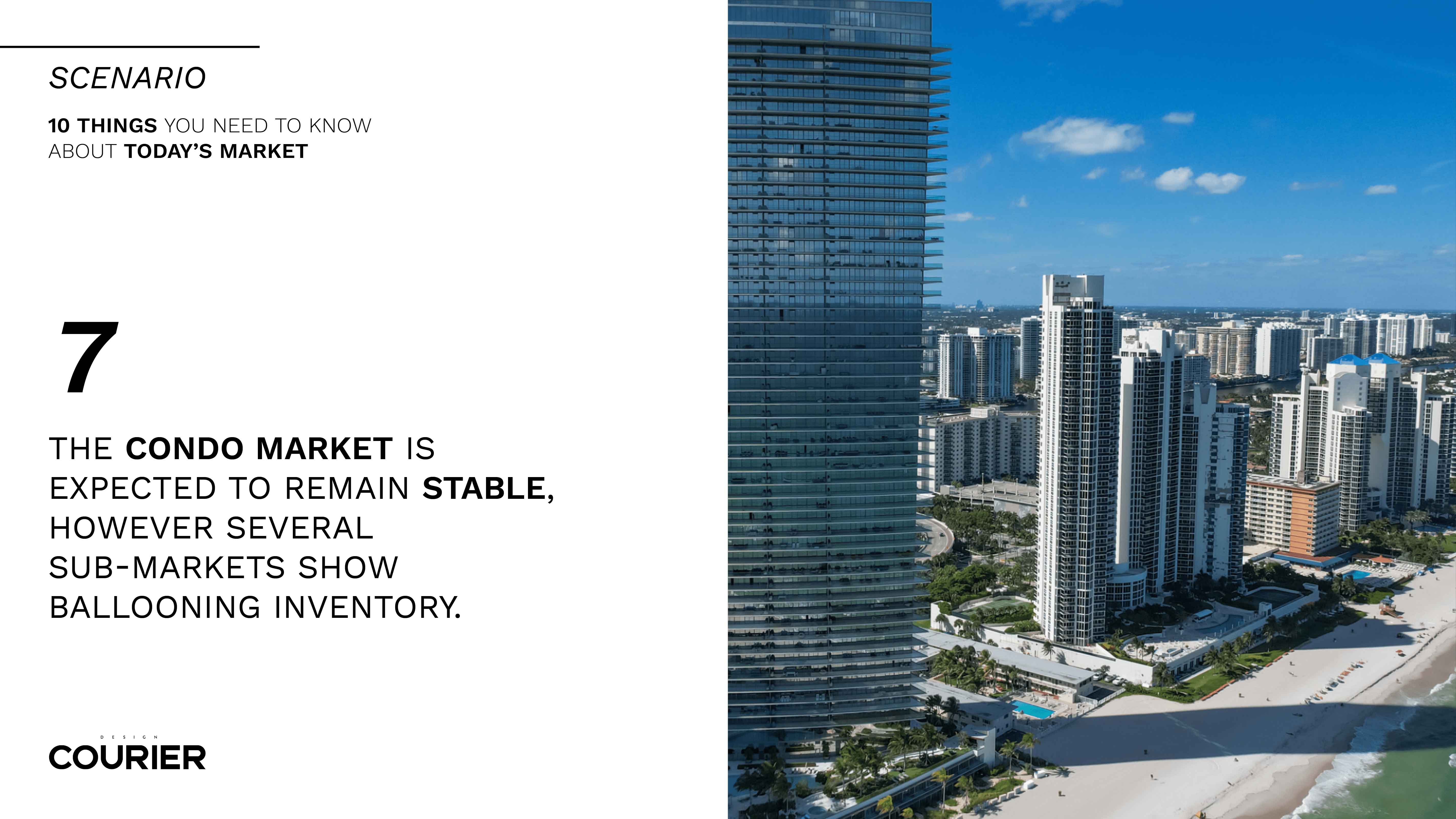

In the last year we have witnessed the doubling of the inventory and great increases of revenues in the ultra-luxury. Although the number is not as high as in other cycles, it is the speed at which this has come about that is really concerning. Therefore, it is important to keep this point in mind and be aware of the way we are moving forward. In Miami there is primarily an investor-type of consumer, that is now seeing some corrections in the rental market of the 7%. This could cause them to start looking at their return, especially in light of the values of the units that have now gone up by as much as 50%, and in some cases 100 %. Indeed, we have seen massive rises of condo product value in the last couple of years.

The positive side of these observations is the long-term factor, which today characterizes the city of Miami. This is witnessed by large groups of hedge funds and financial investments such as Citadel, Millennium and Tigress Capital. There is much business revolving around the financial sector, and bringing year after year hundreds of families to the uptown of Miami. Speaking of critical mass, it emerges that cities like New York, Chicago and Washington DC are still driving engines alongside Miami. An interesting fact that confirms this is that of attrition rate from schools, which remains at the 1%. Therefore, there is no retraction or willingness to return to one’s hometown. These families come to stay.

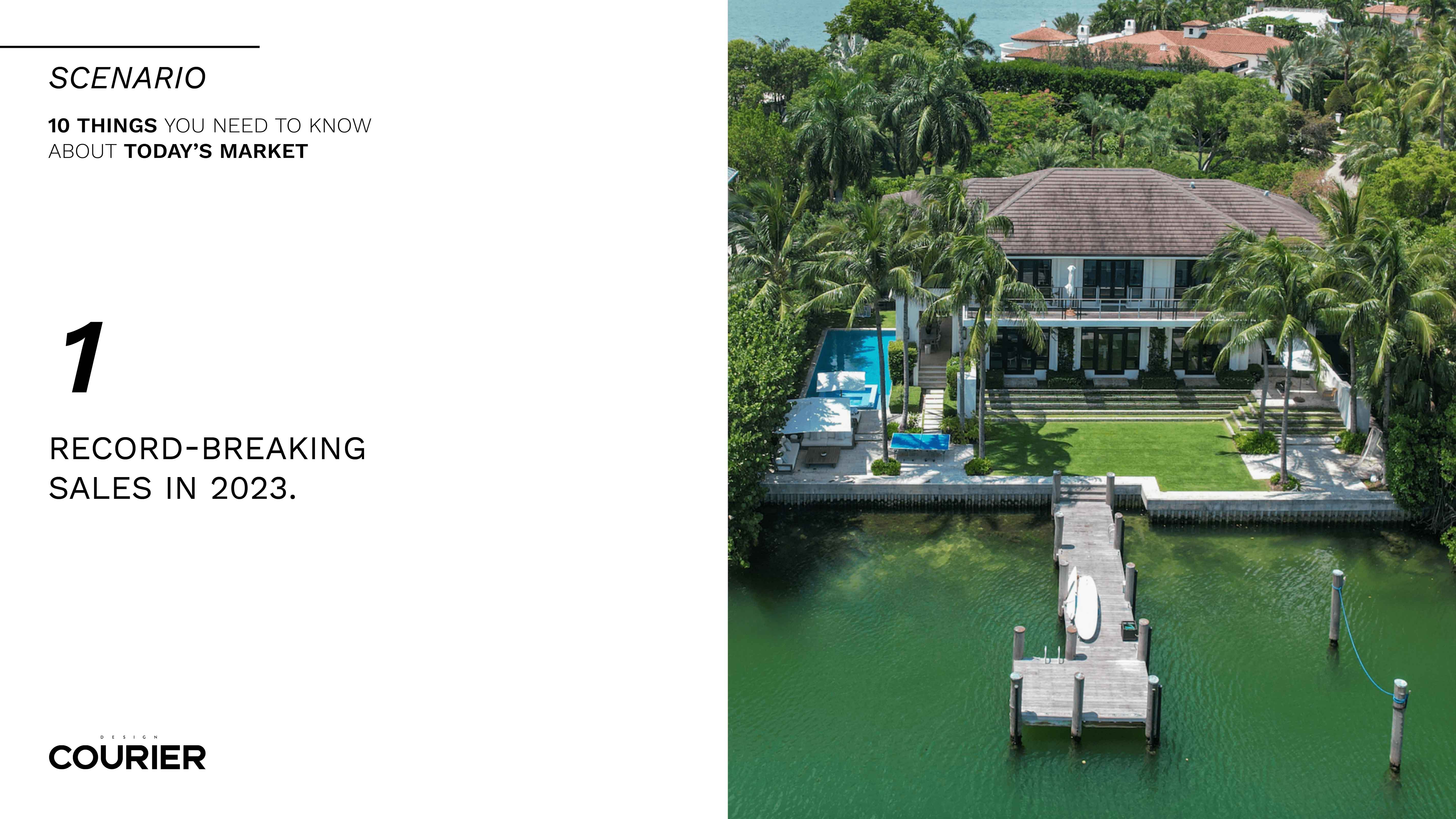

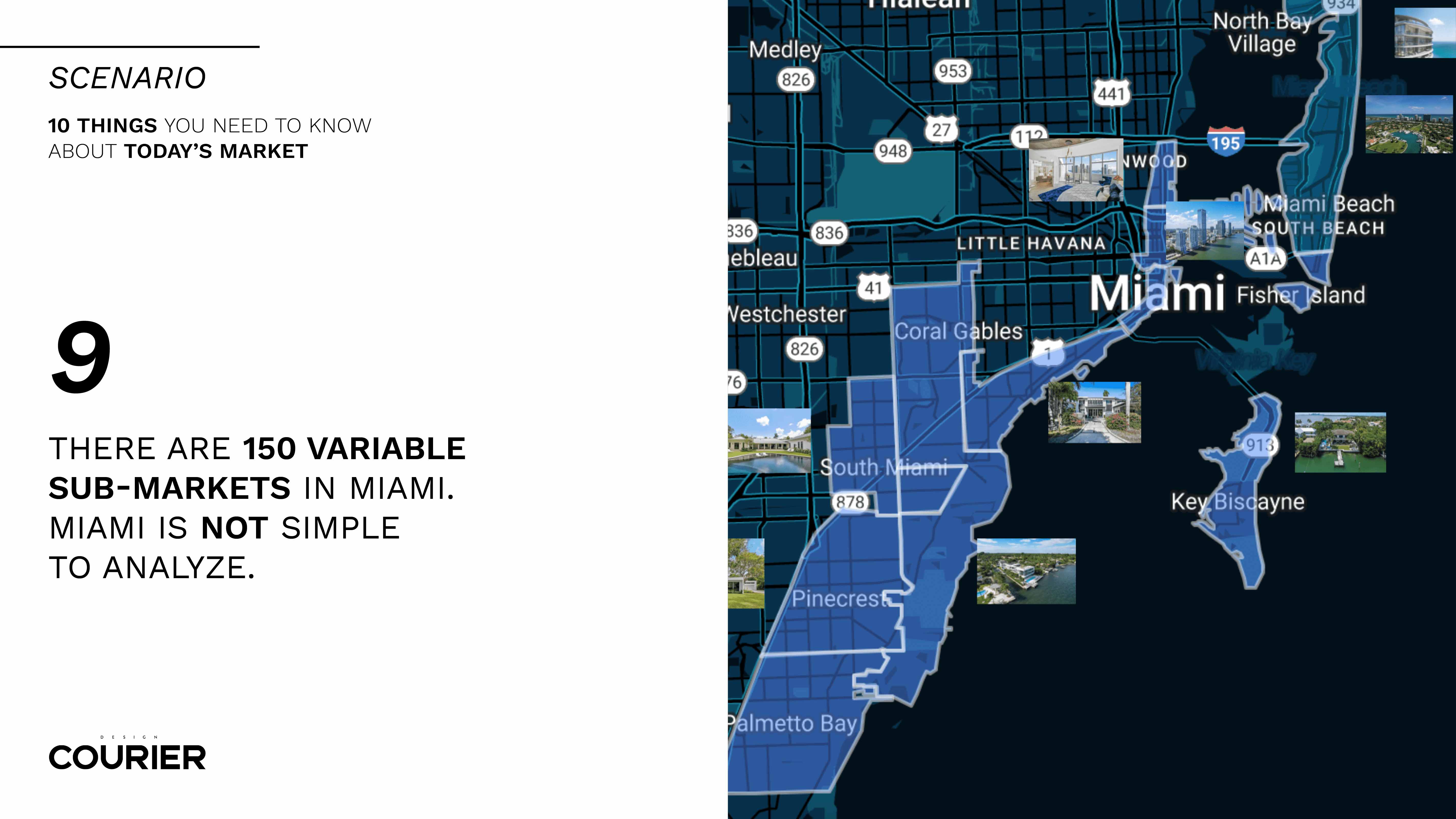

One of the most observed data, both by experts and non-experts in the field, is that of sales. In this regard it is interesting to note that in 2023 sales have dropped in the Miami market. It is called “Seller’s Paradox”. The reason must be searched in the inventory as, if we look outside the luxury sector, it is still very “dry”. Reflecting now on the condominium market, it is the one with the higher development prospects. There are in fact over 30 projects coming to Miami in the next two years. Speaking of figures, we can say that the product that is coming “over the ground” is over 2,000 dollars per square foot for new construction and the beachfront product is over 3,000 per square foot. This industry is selling due to the large audience of buyers. To respond to this demand, builders are developing much larger units, which will lead to new demographic increases. As we are moving forward into the year, we see that figures for single sale are going up. In Miami there are currently 10 houses available over 50 million, and this is a remarkable fact. Therefore, the service will probably slow down, but not the luxury product, as it is what everyone is chasing. The migration of business into Miami is as strong as ever and experts are seeing it going nowhere but up.